Scale, strategy key to delivering Thomson Resources’ silver vision

Mining

Mining

There’s some serious strategy to the way Thomson Resources has gone about assembling a portfolio which it believes will make a transformative silver project on either side of the New South Wales/Queensland border.

Thomson’s (ASX:TMZ) strategy – billed ‘hub and spoke’ by the company – looks set to breathe new life into a suite of silver-gold deposits the market may know by name in a way never before seen.

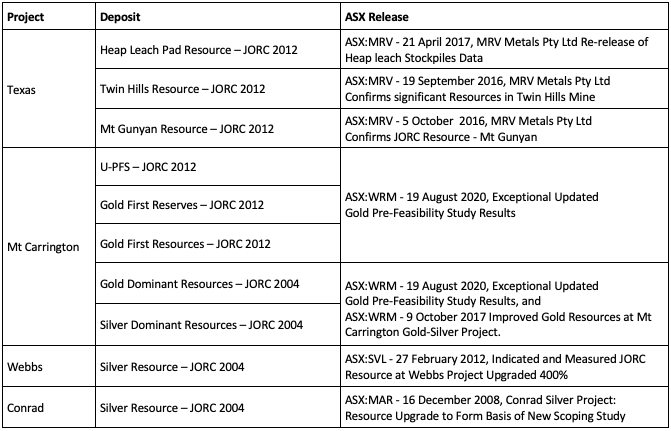

The core hub and spoke assets, each acquired in the last six months, are as follows:

Thomson’s historic Hortons gold project in northern NSW is regarded as a fourth prong to the strategy.

It’s a serious suite of projects, and while a combined resource can’t be declared until some work is done in getting all to JORC 2012 resource level, it gives Thomson a combined scale of project which Executive Chairman, David Williams, believes will set it apart from others who’ve given silver a crack in the region before. The company has a goal of having 100 million ounces of silver equivalent in ground available to a central processing plant, and believes it is close to that mark.

Under the hub and spoke plan, Thomson plans to process ore from the various silver deposits at a centralised location – most likely Texas – a plan which should allow the quality of its assets to shine while cancelling out the hindrances which have set them back in the past.

“The real key to the hub and spoke strategy is having a sufficient resource behind you to be successful,” Williams told Stockhead.

“Mt Carrington is a bit different, but that’s where each of these projects in their own right have ever failed or struggled in the past. They’ve never had a sufficient resource or sufficient capital behind them to succeed.

“With the greatest respect to past operators they were done on the cheap, because they really had to get out there and grab the moment.

“The difference for us is that we’re making sure we have a significant resource, albeit aggregate, behind us, and we’ll be making sure we’re well funded before we embark on developing the resources that sit behind it in a bigger way.

“These projects have never been under one umbrella before. We happened to be in the right place at the right time when they all came up – you wouldn’t read about it.”

The benefits of time and capital mean TMZ can put its energy into better processing methods and look to extract greater value from its varied orebodies.

Mt Carrington comes with both gold and silver-dominant resources, and there are interesting gold and zinc hits on record at Texas. Conrad and Webbs are polymetallic to different extents – minerals that if captured can significantly boost the silver equivalent output from the hub and spoke assets.

What that means is while the heap leach pad at Texas may be ready to fire up, it’s not necessarily the path the company intends to take for its processing in the long term.

“If you go with a more sophisticated process, your recoveries will be vastly superior,” Williams said.

“Heap leach is probably only going to be around that 40-50% mark, whereas a carbon-in-leach recovery process should deliver more around the 80% mark.

“If you start to understand the metallurgy there’s some fairly neat processes out there now where you can do things in stages, and extract minerals first that you’re able to get value for.

“By doing that you increase the value in the ground, and at the same time you’re increasing the silver equivalent in the ground.”

The hub and spoke projects may contain other minerals, but it’s clear that silver is considered the way forward for Thomson.

Williams said the commodity’s future was two-fold – as an alternative precious metal to gold and as a component in a battery tech world.

“Unlike previously, and you can go right back to see silver has had an up and down price pathway, I think the technology aspect is going to change things,” he said.

“Volatility may have come in the past for its precious metal aspect, but I think the combination of the two is going to help sustain prices.”

While these projects are at the forefront of its thinking, the explorer continues to work on its gold and tin assets in the Lachlan Fold belt. Exploration programs are ongoing, with newsflow continuing to come from the Harry Smith gold project and the Bygoo tin asset in NSW, while drilling is planned at the Chillagoe gold project in Queensland mid-year.

Williams said once the hub and spoke strategy was nailed down the company would start reviewing the best ways to achieve shareholder value for these assets.

As far as hub and spoke work goes, the next few months will be all about reaching a position where a combined JORC 2012 resource can be revealed.

Rigs look set to follow, and all going to plan the project will be a hell of a story to tell in the months and years to come.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.